Dig Moats to Find Hidden Gold

The best startups innovate during the most uncertain times to build lasting value.

Many years ago, I traveled to Rajasthan. It is a state in India which was ruled by kings for centuries leading up to India’s independence in 1947. They built magnificent palaces and forts during their time, most of which were surrounded by moats. Moats were important to ensure that the enemy stayed behind enemy lines. If the perpetrator ever tried to cross into the kingdom, the moat provided a substantial impediment to slow down the advent of the marching army such that they could then be defeated or forced to retreat.

Amer Fort, Rajasthan (photo by Dror Ben Davi on Unsplash)

[Fun anecdote: Although I spent my teenage years in Mumbai (then called Bombay), my family belongs to a clan called ‘Marwari’. The name comes from the ‘Marwar’ region in Rajasthan where I can trace back my ancestry.]

Just like kings and kingdoms needed moats to protect their most prized assets, CEOs and companies need moats to thwart or slow-down the threat of competitors. Moats are ‘sustainable competitive advantages’. The word sustainable is key — if the competitive advantage is not sustainable then by definition it means that the advantage is going to erode over time, and the competition, metaphorically speaking, will infiltrate and destroy the kingdom.

This essay is inspired by three articles written by Jerry Neumann. These are Schumpeter on Strategy, A Taxonomy of Moats and Startups and Uncertainty. In particular, this quote at the end of ‘A Taxonomy of Moats’ was the spark: “Uncertainty can be seen everywhere in the startup process: in the people, in the technology, in the product, and in the market. This analysis shows something more interesting though: uncertainty is not just a nuisance startup founders can’t avoid, it is an integral part of what allows startups to be successful. Startups that aim to create value can’t have a moat when they begin, uncertainty is what protects them from competition until a proper moat can be built. Uncertainty becomes their moat”.

Uncertainty and Risk

Before we can talk about moats, it is imperative to distinguish between Uncertainty and Risk. Many adventures and tasks have a defined probability of risk but they are not necessarily uncertain. A game of roulette has a predefined probability distribution of risk. So although in some ways you are placing a risky bet, you do know the probability of the outcome. Other examples of risky outcomes are placing a large bet on a flip of a coin, or an organization selling a dollar note for 90 cents, or the probability that any given mountaineer is going to make it to the top of Mount Everest. By contrast, what is Uncertain is impossible to predict. There is inherently no way of actually knowing what the outcome may be. I am writing this essay in March 2020, a time when the world is facing a global health pandemic due to Coronavirus. Nobody could have predicted that this event would occur at this time and its impact on human life, suffering and world economy. This is an Uncertain event.

[Some people have called the Coronavirus pandemic a Black Swan (made popular by the book of the same name written by Nassim Taleb). In fact, Taleb calls out such an event as White Swan explicitly. It means that such an event should be expected but the Uncertainty is around the timing and impact.]

In the same vein, startups are Uncertain when they get going. There is really no way of a priori knowing whether or not a startup will be successful, or how successful a startup could be and in what time frame. I am not talking about a somewhat mature startup that is rapidly growing or failing. I am pointing at the time in the life of a startup before it has many customers, or before it has a product, or before it has employees other than founders, or before it was even officially ‘founded’. These times are truly Uncertain in the life of a startup. The probability of a startup's success or failure can neither be determined by Deductive or Inductive Reasoning. Startups, by their very nature, are Uncertain endeavors.

On the other hand, large corporations despise Uncertainty. The same processes and organizations that make large corporations successful beyond imagination also keeps them from venturing into Uncertain territory. Processes, check-and-balance, decision-making authority, committees are all structural elements that are responsible for stability and reasonable predictability in large corporations. Instead of venturing into Uncertain territory, organizations take calculated Risk which in turn can lead to incremental innovation and growth, and over time, even lead to building a sustainable competitive advantage a.k.a. moats.

Competition

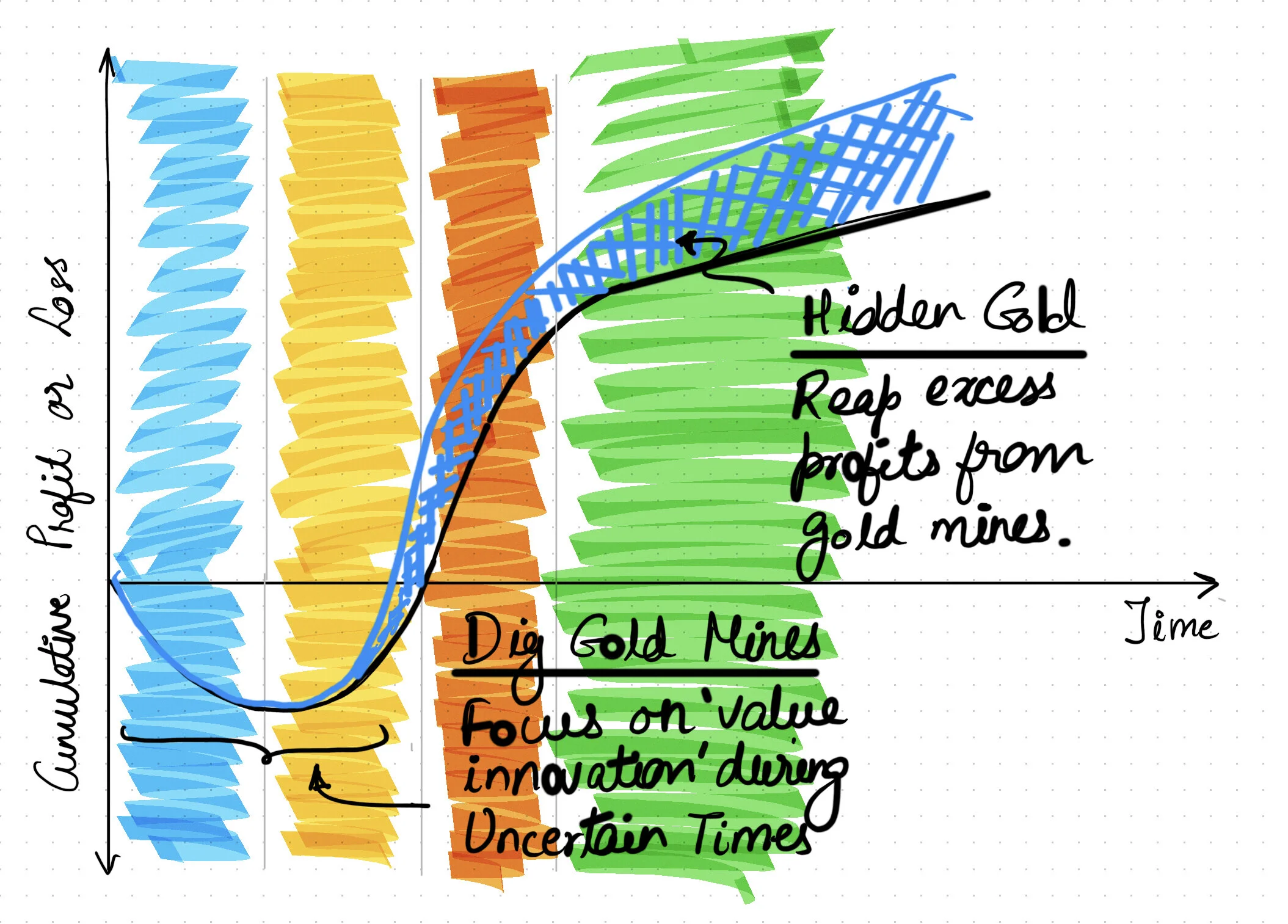

For any startup, large incumbents are formidable competitors. There can also be smaller players or other startups that could pose a threat. However, this does not mean that the competition cares about a startup. In fact, they will surely ignore a startup when it gets going. The chart below illustrates the cumulative profit or loss of a successful venture-backed startup. Such a startup typically goes through 4 key phases through its life:

Pre Product-Market Fit: Competition ignores the startup.

Post Product-Market Fit: Competition acknowledges the startup as an emerging entrant.

High-Growth Stage: Competition fiercely competes with startup.

Mature Stage: This is when the startup becomes the incumbent.

There is in fact a fifth stage, that of stagnation and eventual decline, but we are not discussing this here.

The time before and just after the product-market fit is a very turbulent time in the life of a startup. These times are Uncertain. Once the startup enters the high-growth stage, experimentation gets relegated to taking calculated Risks. I argue that not only Uncertainty becomes a startup’s moat when it gets going but that Uncertain times are also the best time for building a certain kind of moat for a startup. This is the time in a startup’s life when moats that yield the most value can be created via innovation.

Innovation and Moats

There are three large buckets of innovation: a) value innovation or differentiation, b) efficiency innovation or cost leadership, c) a combination of value and efficiency innovation, or focus. I have come across startups that get going by leveraging any one of these innovations.

For startups, cost leadership can create value but value creation of this sort is not generally sustainable, and gets eroded by competition rather quickly. This happens because by virtue of efficiency innovation, the startups aim to compete in a zero-sum game i.e they compete for a slice of the pie that already exists.

Most successful startups get going because they promise differentiation and create value by competing in a positive-sum game i.e competing to take a slice for themselves while literally creating the pie or making an existing pie larger at the same time. Some examples of value innovation include patents, licensing, control of scarce resources, helping create friendly regulation, tacit know-how, customer insight, building early network effects or rigid systems, willingness to experiment, and others.

Implications and Strategy for Startups*

Value innovation, in my view, should be best implemented and accelerated during the Uncertain stages of a startup. The competition ignores the startup during Uncertain times so it provides the startup the luxury of time for experimentation. It is my belief that differentiation and innovation built during Uncertain times create value that pays off over a long period of time into the future that would have been otherwise eroded by competition. This sort of innovation during Uncertain time results in discovering and excavating the ‘Gold Mine’ that yields the ‘Hidden Gold’ over a sustained period of time. This is illustrated in the figure below.

The illustration assumes that a focus on ‘value innovation’ or ‘differentiation’ during Uncertain times results in faster growth and a higher level of sustained value creation. The illustration also assumes that a startup pursuing this strategy would require (approximately) the same amount of resources ($) to generate additional long-term value, and perhaps, a shorter time to reach a break-even point. This is counterintuitive to most at first glance — skeptics generally make the assumption that creating differentiation requires more resources and time. However, my personal experience with startups has shown that unwavering focus on value innovation and differentiation can in fact have the effect of wasting less resources during Uncertain times and during the growth and mature stages of the company. Every startup will have its own path to charter. Even if some startups do end up requiring more $ and/or time to dig Gold Mines, the sustained value and excess profits from Hidden Gold will more than compensate, in the long run, for the extra resources spent during Uncertain times.

There are many deliberate steps a startup can take early-on to ensure that it sets itself up to mine the Hidden Gold. These are:

1. Decide what it would need to do to create a moat during Uncertain times and allocate sufficient time and resources to do so.

2. Communicate to all stakeholders (employees, investors, advisors, early partners, early customers, etc.) a strategy. Develop a near-term execution plan that aligns with this strategy. If necessary, also make it very clear that this strategy may require more time or more $ or both as compared to not explicitly pursuing such a strategy.

3. Align itself with investors and employees that understand that building such a moat will require experimentation and unwavering focus.

4. Stay in stealth for as long as possible during Uncertain times but also aggressively pursue early customers and partners, and be very open with them.

5. Focus on building your moat that will give you pricing power in the long run. This means not only protecting your intellectual property, trade secrets and tacit knowledge but also ensuring that key employees that are responsible for creating moats are disproportionately rewarded compared to the rest of the organization.

6. Once the moat is in place, market aggressively to attract new customers at a fast pace.

Peter Thiel says, “There are quite a lot of people who think my aspirations are not possible. That's a good thing. We don't need to really worry about these people very much, because since they don't think it's possible they won't take us very seriously- and they will not actually try to stop us until it's too late.”

Building moats during Uncertain times will ensure that the valuable time your competition dwindles away will be worth the wait!

* Edited: April 10, 2020